In August 2017, we conducted a research exercise where we analysed a large sample of the user generated content on our website from the banking industry. The primary goal of the project was to understand consumer sentiment in the banking industry and how banks could better facilitate complaint resolutions.

The report unearthed some interesting findings, which we have decided to summarise for your reading pleasure.

The report was broken down into 4 main sections:

- The Executive Summary consolidating the findings giving the report a holistic view.

- An analysis of the industry as a whole to determine where the majority of complaints stemmed from.

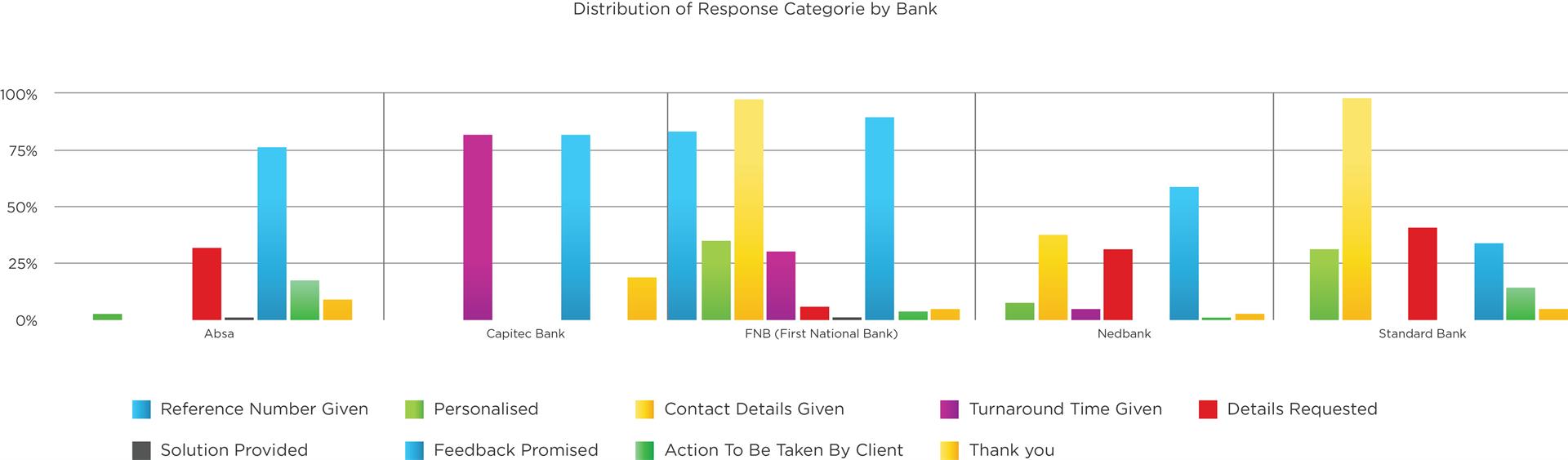

- A competitor analysis that compared the BIG 5 banks to each other in order to establish what each banks’ advantages and disadvantages were in their processes, products and services.

- And recommendations on how banks could better handle complaints and compliments in order to build their reputation, promote their business and develop better relationships with their customers.

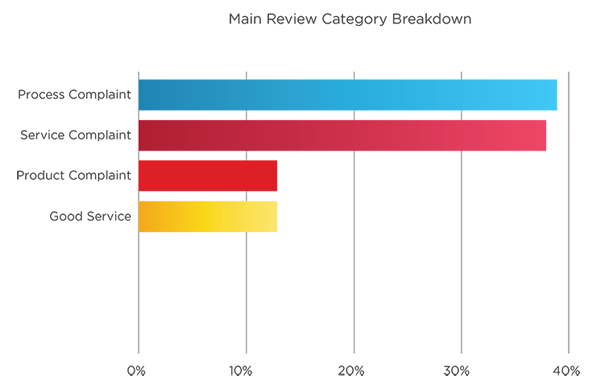

The recurring themes that stood out were the high volume of complaints related to services, processes and products. From these categories, we also established subcategories that gave us much deeper insights into the problems that consumers face on a daily basis. Here are some of the issues that stood out:

- Failure of banks to close accounts upon client request resulting in bank charges,

- FICA information not being updated correctly,

- Failure to deliver new credit cards, and

- Inconsistent information from different bank representatives.

Hellopeter.com is also on a path to become a positive tech and data partner. So over and above the issues we also identified some learnings for the banks to adopt to improve customer experiences:

-

- Response time matters. Banks that responded to reviews on our platform within 5 hours experienced much higher ratings once the review was converted. This suggests that customers generally understand that mistakes happen and when a bank is quick to respond, the customer’s trust is reinstated and they are assured that their best interests are taken into account.

- Providing a timeframe matters. Nothing is worse than having to sit around waiting and wondering if your issue is on your bank’s radar. By providing a timeframe banks are creating an expectation that the issue is being looked into and will be resolved at a certain time. This contributes to better relationships between Banks and their customers.

- After the holiday season people are more likely to complain. We’ve all be there. By the time February rolls around and the festive season memories begin to fade we take more notice of our bank balance and realise that maybe some of the things we splurged on weren’t such a good idea. Coupled with admin errors and incorrect debit orders going off customers’ accounts tends to push some of us over the edge and as a result we saw a spike in complaints during this period.

- 30 – 50-year olds are the least happy in the sector. Our in-depth research found that people in this age bracket tend to complain more because they have more complex financial requirements compared to young or retired people.

Reviews on Hellopeter have Helped over 1 million customers make better choices. Had an experience you’d like to tell us about? Leave us a review here.